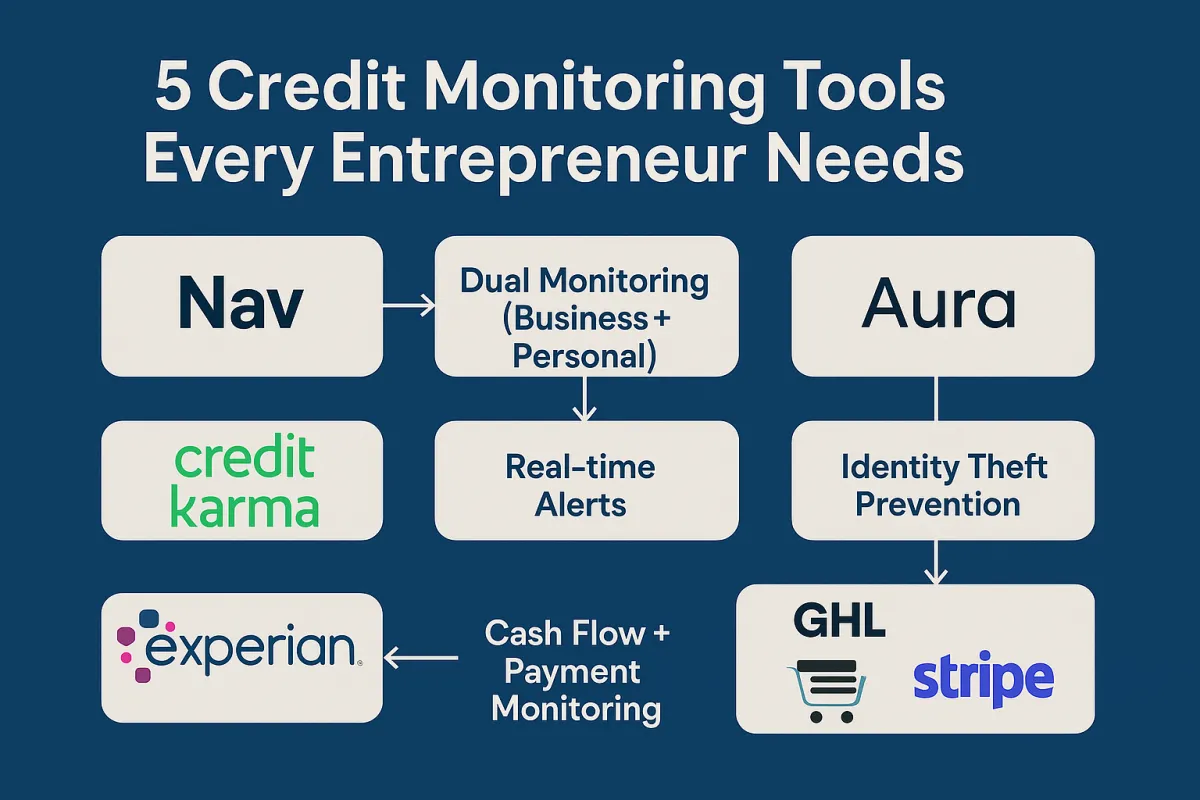

5 Credit Monitoring Tools Every Entrepreneur Needs in 2025

Whether you’re applying for funding, building business credit, or protecting your identity, credit monitoring is non-negotiable in 2025. This guide covers five trusted tools that entrepreneurs use to stay ahead—and how each one helps you grow smarter.

What You’ll Learn

In this post, you’ll uncover five essential credit monitoring platforms that every entrepreneur should consider using—especially if you plan to fund, scale, or protect your business. Learn which tools offer real-time alerts, identity protection, and business credit tracking, plus how to use them to position yourself for long-term growth.

Why Credit Monitoring Is Essential for Entrepreneurs

Did you know a single missed payment can drop your credit score by over 100 points?

In 2025, credit plays a bigger role than ever. From funding approvals to insurance rates to vendor partnerships—your personal and business credit profile impacts your opportunities. And yet, most entrepreneurs don’t track their credit until there’s a problem.

At Zaza Living, we’ve seen clients lose out on 6-figure financing simply because they didn’t know there was an error on their report. That’s why we recommend proactive monitoring tools—so you can catch issues early, protect your profile, and leverage credit when it matters most.

Tool #1: Nav – For Business & Personal Credit Monitoring in One Dashboard

Nav is one of the only platforms that tracks both your personal and business credit in one place—making it ideal for entrepreneurs juggling both.

Key Features:

Access your business credit scores (D&B, Experian, Equifax)

View your personal credit reports from TransUnion & Experian

Get tailored financing recommendations based on your profile

Monitor score changes and get alerts for key events

Offers business credit builder plans

💡 Tip: Nav’s paid plans can also report trade lines to help you build business credit faster.

✅ Takeaway: Nav is perfect for entrepreneurs who want a complete snapshot of their credit health—both business and personal.

Tool #2: Credit Karma – Real-Time Personal Credit Monitoring (Free)

Credit Karma remains a go-to tool for tracking your personal credit health—completely free.

What You Get:

Weekly updates from Equifax and TransUnion

Personalized tips to improve your score

Alerts for new accounts or inquiries

Simulated credit score projections

Free tax filing and identity monitoring

Who it’s best for:

Founders or landlords who fund their ventures with personal credit (especially early on).

✅ Takeaway: Credit Karma is your first defense against fraud and sudden score drops. Use it to stay one step ahead.

Tool #3: Experian Business Credit Advantage – Monitor & Improve Your Business Score

Your Experian Business Credit Report is one of the most used data sets for lenders, banks, and suppliers. This tool gives you direct access to it—with actionable insights.

Key Features:

Unlimited access to your Experian business score

Real-time alerts for inquiries or changes

Risk factor analysis & score breakdown

Option to add trade references

Who it’s best for:

Business owners who apply for loans, lines of credit, or work with vendors.

✅ Takeaway: Knowing your Experian score helps you negotiate better terms and catch red flags early.

Tool #4: Aura – Identity & Credit Protection in One

Aura goes beyond traditional credit monitoring—it’s a full identity protection suite that alerts you to suspicious activity across multiple platforms.

What Makes Aura Stand Out:

Monitors all 3 credit bureaus

Real-time fraud alerts and dark web scans

Bank and account monitoring

$1 million identity theft insurance

VPN and password manager included

Who it’s best for:

Entrepreneurs concerned about data breaches, fraud, or protecting personal assets while scaling.

✅ Takeaway: Aura gives peace of mind—whether you’re traveling, hiring, or expanding online operations.

Tool #5: Go High Level (GHL) + Stripe Integration – Track Revenue, Declines & Billing Health

While Go High Level is widely known for CRM and automations, its Stripe integration lets you track financial activity tied to client billing—a form of credit control for service businesses.

GHL + Stripe Monitoring Benefits:

Get real-time updates on failed payments

Automate reminders for declined charges or late invoices

See revenue trends over time

Protect your cash flow before it affects your credit

Use automations to resolve payment issues quickly

Who it’s best for:

Service-based businesses, agencies, or coaches who bill clients monthly and rely on smooth cash flow.

💡 Tip: Missed payments from clients can cause your own credit issues if you’re not getting paid on time. GHL helps automate protection.

✅ Takeaway: Go High Level helps you catch cash flow issues before they hurt your score or repayment capabilities.

Real-World Scenario: How One Houston Business Owner Caught a Costly Error

Olivia, a local short-term rental owner in Houston, noticed her loan applications were getting denied—even with strong revenue.

After signing up for Nav, she discovered a closed personal card was still reporting a $3,500 balance on her business file through Experian. Within 30 days of disputing it, her business score jumped 18 points—and she secured a $50K LOC at 8% APR.

✅ Lesson Learned: Without monitoring tools, even simple reporting errors can block funding opportunities.

Final Thoughts: Don’t Let Unknowns Hurt Your Business

Whether you're building a real estate portfolio, scaling a service business, or preparing for funding—credit is leverage. Monitoring your personal and business credit is like checking your vitals before making big moves.

Don't wait for a declined application or an identity breach to act.

Ready to Take Control of Your Credit Health?

At Zaza Living, we help entrepreneurs and investors build financial clarity—on and off the balance sheet.

👉 Join the Zaza Insider Group to access our free credit-building tools, funding strategies, and checklists.

👉 Explore our Real Estate & Funding Services to grow with confidence in 2025.

Related Articles from Zaza Living: